Democratizing Financial Search

Most investors have limited access to data and information.

With our technology every firm can empower its user base.

THINKalpha delivers sophistication without complexity.

API Integration

Empower chat, search, GUIs, and any workflow.

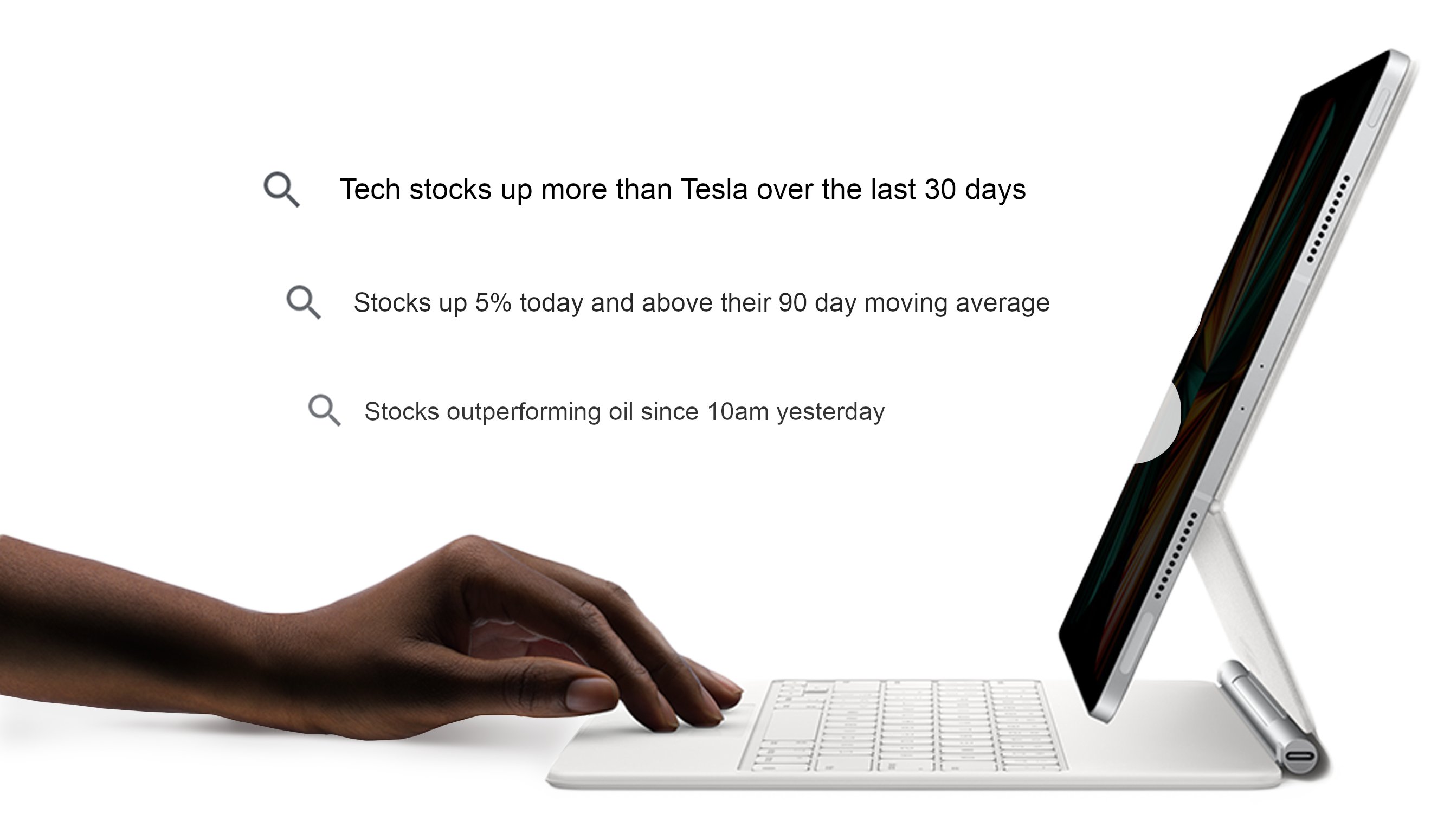

Integrated search

Transform input boxes with AI-enabled financial search and intelligent suggestions.

Spreadsheet Magic

Dramatically simplify research. Build a spreadsheet with a question!

Chatbot Integration

A powerful research assistant.

Integrated Content

Dynamically generated and engaging

Seamlessly integrate financial search and research via microservices, API integration, and/or custom enterprise engagement.

Natural Language and AI empower user workflow with intelligence and dynamic views.

Democratizing Financial Search

Contact us

to Learn More.